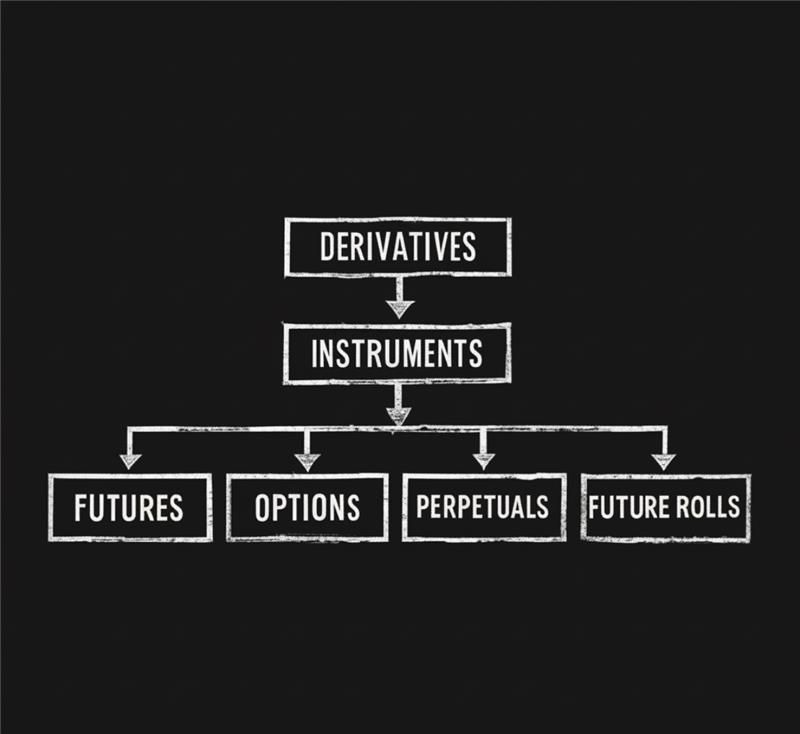

Options Basics

- Defined by strike and expiry.

- Buyers have rights, sellers have obligations.

- Moneyness is ITM or ATM or OTM. Premium is the upfront price.

- Payoffs are convex and depend on price, time, and implied volatility.

Perpetuals Basics

- No expiry.

- Funding transfers between longs and shorts and tethers price to spot.

- Leverage improves capital efficiency but raises liquidation risk.

- Use Reduce-Only on protection orders and keep headroom above maintenance.

Future Rolls Basics

- A roll is long one expiry and short another.

- Use it to move exposure forward or to trade term structure.

- On Thalex rolls are margin efficient.

- Size both legs so net delta is near zero if you only want curve exposure. Sequence legs by liquidity and monitor roll basis and margin headroom.

Volume

Volume is the count of contracts traded over a period. It reflects participation and helps confirm or question price moves. Rising price with rising volume usually signals broad participation; rising price on falling volume often signals a thin move that is easier to fade. Volume spikes around levels reveal where traders committed size, which often becomes support or resistance on retests. In derivatives, volume prints per instrument and per maturity, so always compare like for like. For context, high volume tends to compress spreads and reduce slippage, while thin volume does the opposite.

Open-Interest (OI)

Open interest (OI) is the number of outstanding derivative contracts that have not been closed or settled. OI rises when new longs and shorts open a fresh pair of contracts; it falls when existing positions are closed. Price up with OI up usually signals trend strength; price up with OI down often signals short covering. Treat these as heuristics, not laws. Use OI to track capital flows and liquidity by expiry and strike, not just at the aggregate level.