Trading Information

Market Quality Program

Overview

Market Quality Score (MQS) measures the relative quality of liquidity provided by orders in the order book. It is the primary determinant for Liquidity Pools reward allocation.

Price levels are discounted in function of distance to the Mid Price ("Price Distance Discounting"), and are used to calculate price scores ("PS"). These scores are multipled with order size ("Q") to get a Top of Book Equivalent ("TOBE") score. MQS is calculated by dividing the TOBE of an order by the sum total TOBE of all orders in that order book.

i.e. MQS is the share of rewards received for the order book snapshot.

Price Distance Discounting

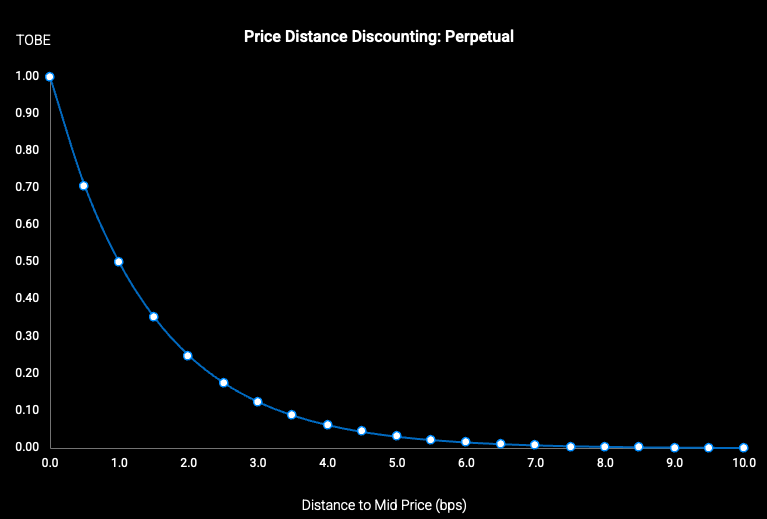

Price scores use Normalized Distance ("ND") as the input to a non-linear discounting function.

For example, the price scoring is 0.5ND for perpetuals and 0.1ND for options. ND is calculated as

where Price Distance is the absolute difference between the Mid Price (Pmid= Pbest bid + Pbest ask / 2) and the order price (Porder).

Target Distance varies by product group and instrument, and is expressed as basis points (bps) of the index price.

The below graph visualizes this discounting

Top of Book Equivalent (TOBE)

The TOBE score of an order measures its size-adjusted contribution considering its price distance

The aggregate TOBE of an order book, TOBEsum, is used to determine the snapshot reward scaling MSR% relative to TOBEmin and TOBEmax targets.

Market Quality Score (MQS)

The MQS for each order is its TOBE score relative to the sum of TOBE scores in the order book for the instrument

A participant's MQS for an order book snapshot is the sum of the MQS of all their orders

This MQSparticipant score determines the participant's share of the snapshot reward SRorder_book for Liquidity Pools.

Example

Let's assume for BTC - Perpetual that the index price is $100,000. The Target Distance is 0.5 bps * $100,000 = $5.

Using the 0.5ND discounting, the MQS is calculated as follows:

| Ask | Price (USD) | Size (BTC) | PD (USD) | ND (bps) | PS (Score) | TOBE (Score) | MQS (%) |

|---|---|---|---|---|---|---|---|

| E | $100,038 | 5 | 34.0 | 6.80 | 0.01 | 0.04 | 2.8% |

| D | $100,028 | 2 | 24.0 | 4.80 | 0.04 | 0.07 | 4.5% |

| C | $100,019 | 1 | 15.0 | 3.00 | 0.13 | 0.13 | 7.7% |

| B | $100,014 | 0.6 | 10.0 | 2.00 | 0.25 | 0.15 | 9.3% |

| A | $100,008 | 0.4 | 4.0 | 0.80 | 0.57 | 0.23 | 14.2% |

Mid Price | $100,004 | TOBEbid | 0.99 | TOBEask | 0.62 | TOBEsum | 1.61 |

| Bid | Price (USD) | Size (BTC) | PD (USD) | ND (bps) | PS (Score) | TOBE (Score) | MQS (%) |

|---|---|---|---|---|---|---|---|

| A | $100,000 | 0.5 | 4.0 | 0.80 | 0.57 | 0.29 | 17.8% |

| B | $99,994 | 1 | 10.0 | 2.00 | 0.25 | 0.25 | 15.5% |

| C | $99,988 | 2 | 16.0 | 3.20 | 0.11 | 0.22 | 13.5% |

| D | $99,982 | 5 | 22.0 | 4.40 | 0.05 | 0.24 | 14.7% |

TOBE scores may be capped for certain instruments. Example uses illustrative non-capped values.

Liquidity Pools Rewards

Liquidity Pools rewards are allocated based on a participant's share of the total MQS within each pool and instrument calculated across ~8,000 daily snapshots.

A total of up to $250,000 USDt is allocated monthly across the following Liquidity Pools:

| Product Group | Monthly Pool | BTC Share (50%) | ETH Share (50%) |

|---|---|---|---|

| Perpetual | $85,000 | $42,500 | $42,500 |

| Options - Tier A* | $60,000 | $30,000 | $30,000 |

| Options - Tier B* | $25,000 | $12,500 | $12,500 |

| Rolls | $80,000 | $40,000 | $40,000 |

| Total | $250,000 | $125,000 | $125,000 |

*Eligible Options Tiers: See Terms & Conditions

Reward Scaling

The total reward available for each individual snapshot SRorder_book depends on the overall liquidity quality (TOBEsum) of that snapshot relative to the defined minimum (TOBEmin) and maximum (TOBEmax) thresholds for the instrument.

Maximum Reward

The MSRmax represents the maximum possible reward for a single snapshot for a specific instrument, derived from the monthly pool allocation

Minimum Liquidity Check

No reward is paid for the snapshot if the liquidity on either the bid or ask side is below half the minimum threshold

Linear Reward Scaling

If the minimum check is passed, the snapshot reward (SRorder_book) scales linearly from 0% to 100% of the Maximum Snapshot Reward (MSRmax) as the total TOBEsum increases from TOBEmin up to TOBEmax

A participant's raw reward entitlement per snapshot is MQSparticipant × SRorder_book. The daily sum of these entitlements forms the basis for the reward, subject to the potential Volume Share Adjustment.

Volume Pool Rewards

Volume Pool rewards are allocated based on a participant's share of daily maker trading volume compared to combined maker trading volume of all eligible participants in a day.

A total of up to $250,000 USDt is allocated monthly depending on total exchange volume.

An account's maker trading volume is the total volume of all trades where the account's limit order was resting in the book and was executed on by another party.

Volume Pool Size Scaling

The daily size of the Volume Pool, Pdaily, scales linearly based on the total daily exchange volume, Vdaily, across all products as a percentage of the maximum (Vmax = $120,000,000) volume threshold.

The Maximum Daily Volume Pool size, Pmax_daily, is possible if the daily equivalent of the $250,000 monthly maximum is larger than the maximum volume threshold. In other words, Pmax_daily if Vdaily > Vmax

See Terms & Conditions for the eligibility criteria and distribution rules.

Volume Pool Summary

- Eligibility Check (Daily): Participant must have a minimum daily "maker" trading volume of $100,000. (Maker trades are trades where the participant's limit order was resting in the book and was executed on by another party).

- Daily Reward Pool Size Calculation: Determined by total exchange volume ($0 -$120,000,000 range).

- Volume Share Calculation: Participant Share = Participant Maker Volume / Total Maker Volume of all eligible participants.

- Reward Calculation: Participant Daily Volume Reward = Participant Share x Daily Reward Pool Size.

Terms & Conditions

| Category | Details |

|---|---|

| Eligibility | All Participants are eligible, provided their account (or subaccount) maintains a margin balance ≥ $1,000, and they comply with the Terms of Use and Rulebook. |

| Eligible Instruments (BTC & ETH) | Perpetuals: All BTC & ETH Perpetuals. Options Tier A: Weekly, monthly, or quarterly expiries with absolute delta between 25 and first ITM (inclusive). Options Tier B: Any option not in Tier A with delta between 5 and 90 (inclusive). Rolls: All Futures Rolls instruments. |

| Liquidity Pools Allocation | Monthly amounts (split 50% BTC / 50% ETH): Perpetuals: $85,000 Options Tier A: $60,000 Options Tier B: $25,000 Rolls: $80,000. |

| Price Discounting (BTC & ETH) | Perpetuals: Price Score = 0.5ND, Target Distance = 0.5 bps * Index. Rolls: Price Score = 0.1ND, Target Distance = 1 bps * Index (< 7 days), 2bps (7 days to 60 days), 3 bps (> 60 days). Options (A & B): Price Score = 0.1ND, Target Distance = bps (Δ) * Index, |

| TOBEmin, TOBEmax | Perpetuals BTC: 0.1, 2.0 Perpetuals ETH: 4.0, 80.0 Options BTC (A & B): 0.1, 2.0 Options ETH (A & B): 4.0, 80.0 Rolls BTC: 0.3, 3.0 Rolls ETH: 12.0, 120.0 |

| TOBE Order Cap | TOBE scores for individual orders are capped on the following instruments: Perpetuals BTC: 0.5 Perpetuals ETH: 20.0 Rolls BTC: 1.0 Rolls ETH: 40.0 |

| Volume Pool | Max Pool: $250,000 per month. Scaling: Daily, based on total exchange volume. Pool scales from 0-100% daily payouts between $0 to $120,000,000 total exchange volume. Eligibility: Maker volume of at least $100,000 in a given trading day. Maker Volume: An account's maker trading volume is the total volume of all trades where the account's limit order was resting in the book and was executed on by another party. Distribution: Proportional share of total maker volume among eligible participants. |

| Reward Calculation Period | Daily, from 8 AM UTC to 8 AM UTC the following day. |

| Reward Settlement | Thalex strives to make reward payment(s) within 10 business days. Rewards are settled in the Settlement Coin (USDt). |

| Exclusions | Thalex reserves the right to disqualify participants or exclude rewards for unfair advantages, abusive trading, self-trades, or violations of the Rulebook/Terms of Use, at its sole discretion. |

| Term | This version of the program runs from 16th September 2025 to 1st July 2026, unless terminated earlier at Thalex's discretion. Calculations and decisions by Thalex are binding and final (except manifest error). Methodologies may change prospectively. |

| Disputes | Any disputes arising from the rewards program will be resolved in accordance with these Terms, together with the Terms of Use and the Rulebook. Thalex is the sole interpreter of the terms of this Program. |