Market Quality Program

Our new Market Quality Program ("MQP") runs through 1st July 2026, paying out up to $500,000 USDt each month. Rewards are subject to the Terms & Conditions specified below.

What is it?

Thalex's Market Quality Program ("MQP") is an incentive program that rewards Thalex customers who make meaningful contributions to the liquidity and volume on Thalex. Every month, up to $500,000 USDt is available to anyone trading on Thalex.

The MQP incentivizes making markets on Thalex to offer competitive and tight quotes. In contrast to TradFi exchanges, Thalex's MQP is open to all customers instead of only being available to large market makers.

MQP consists of two reward categories:

- Liquidity Pools (Up to $250,000 USDt/month): Rewards anyone with high-quality limit orders in the Thalex books.

- Volume Pool (Up to $250,000 USDt/month): Rewards trading volume, distributed among those with at least $100,000 of maker trading volume in a trading day.

Rewards are calculated on a daily basis and paid out in USDt directly into the customer's accounts.

Liquidity Pools

Each month, a total of up to $250,000 USDt is available to anyone with limit orders in the Thalex order books. The only requirement for eligibility is a minimum margin balance of at least $1,000 USD. This means that the liquidity pools are not just for corporate customers and market makers. Any retail trader can participate, provided that they have good quotes in the market.

Liquidity pool sizes are different for each product group. Each month, the following rewards are available.

| Product Group | Monthly Pool | BTC Share (50%) | ETH Share (50%) |

|---|---|---|---|

| Perpetual | $85,000 | $42,500 | $42,500 |

| Options - Tier A* | $60,000 | $30,000 | $30,000 |

| Options - Tier B* | $25,000 | $12,500 | $12,500 |

| Rolls | $80,000 | $40,000 | $40,000 |

| Total | $250,000 | $125,000 | $125,000 |

*Tier A: weeklies, monthlies and quarterlies with a delta between 25 and first ITM (inclusive)

*Tier B: any option not in Tier A and a delta between 5 and 90 (inclusive)

Every day, throughout the day, ~8,000 order book snapshots are taken. Each snapshot has an equal share of the daily Reward Pool available. For product groups with multiple eligible instruments, the reward pool is divided equally among these instruments. In effect, each snapshot has its own share of the reward pool.

To calculate rewards for an account, we look at each order in the order book snapshots and rate its quality. Better-quality orders earn a higher share of the rewards. For more details on how scoring works, check the documentation here.

Volume Pool

A total of up to $250,000 USDt is allocated monthly to reward those who generate volume in any instrument on Thalex.

Every day, a pool of a little over $8,200 USDt is available. How much of this reward is distributed depends on that day's total volume in all instruments combined. If total daily volume on Thalex is $120,000,000 or higher, the full reward pool is distributed. Between $0 and $120M, the reward pool scale linearly from 0 to 100%.

To be eligible for this reward, an account has to have a minimum notional maker trading volume of $100,000 for that day. The daily rewards are fully distributed to all eligible accounts based on their respective maker trading volume. Maker trades are trades where the participant's limit order was resting in the book and was executed on by another party.

Details can be found in the documentation here.

FAQ

How do I register for this?

You will automatically be registered once you start quoting. Any account with a minimum margin balance of $1,000 automatically participates in the Liquidity Pools and the only thing you have to do is have good orders in the book. To be eligible for the Volume Pool on a given day, you need a minimum maker trading volume of $100,000 that day.

Trading days start and end at 8AM UTC.

Where can I see my performance?

In your Market Quality page, you can find your rewards in each pool for the last day, 7 days and 30 days.

Is this only for corporate traders and market makers?

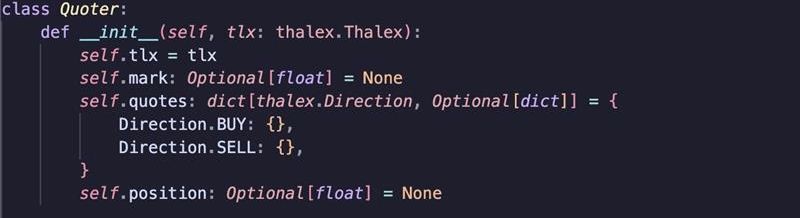

No. Anyone can participate in MQP. In fact, just over the last year, we have paid over $70,000 in MQP rewards to retail traders who wrote their own market maker bots.