What is an Option?

Options are derivative contracts that let you amplify returns, manage risk, and generate income without owning the asset outright. Calls give the right to buy at a preset strike, puts give the right to sell. With the right structure you can target direction, volatility, or income while defining maximum loss in advance. The tool is powerful. Results depend on how precisely you match the strategy to your objective and risk tolerance. The purpose of an option contract is to provide strategic flexibility. Results hinge on matching structure, timing, and risk limits to your objective.

Options add leverage with defined risk, hedge portfolio drawdowns, and create income through premium harvesting. They let you target direction, volatility, and timing with precision. Structures translate views into controlled payoffs. By choosing strikes, expiries, and combinations, you can tailor for up, down, or sideways markets. Clear objectives, sizing, and exits drive outcomes.

Options Premium

The premium is the option’s price. It reflects the underlying level, distance to strike, time to expiry, implied volatility, and rates. Premium tends to rise as options move in the money or as implied volatility increases, and it decays as time passes. PnL equals the change between entry and exit premium. Call break-even is strike plus premium. Put break-even is strike minus premium.

The bid is the premium buyers will pay and the ask is what sellers will accept. The difference is the bid-ask spread and it is your immediate trading cost. Tighter spreads signal better liquidity and lower slippage. Use liquid expiries and strikes for cleaner fills. Prefer limits when spreads are wide. Depth behind the top of book matters.

Instrinsic vs. Extrinsic Value

Intrinsic value is how much an option is in the money. For a call it is max(underlying minus strike, zero). For a put it is max(strike minus underlying, zero).

Extrinsic value is the remainder of the premium driven by time and implied volatility. As expiry nears, extrinsic decays and price converge to intrinsic.

Total premium equals intrinsic plus extrinsic. Far-dated options carry more extrinsic value.

Implied Volatility vs. Realised Volatility

Implied volatility is the market’s forward view of movement embedded in option prices.

Realised volatility measures how much the underlying actually moved over a past window.

The gap between them guides whether to own or sell premium. When realised tends to beat implied after costs, long premium can work. When implied runs rich to realized, premium selling or spreads can be more efficient. Term structure and events shape this choice.

Moneyness of an Option

The strike price of an option is the fixed price which the owner of a contract has the right to buy/sell the underlying. It acts as the central value upon which the profitablity of the option is calculated; it defines the point at which the contract becomes financially beneficial to execute.

The relationship between the underlyinng’s market price and the strike price is what determines whether an option is In-the-Money (ITM), At-the-Money (ATM), or Out-of-the-Money (OTM):

- A call is ITM when the asset price is above the strike price, while a put is ITM when the asset price is below the strike price. The option has immediate value and exercising it would result in a profit.

- A call is OTM when the asset price is below the strike price, while a put is OTM when the asset price is above the strike price. The option has no immediate value.

- ATM refers to when the asset price is very close to the strike price. ATM options are highly sensitive to changes in the assets price and time decay.

Cash-Settlement vs. Physical-Settlement

Physical settlement delivers the underlying at exercise. Cash settlement pays the difference between the settlement value and the strike, so no delivery occurs. Cash settlement keeps operations clean and avoids assignment surprises. Crypto venues favor cash settlement for speed and simplicity. Thalex options are cash-settled and auto-settle at expiry against the index.

Options Styles

Style governs when exercise can occur. American options can be exercised any time up to expiry. European options can only be exercised on the expiry date. Bermudan options allow exercise on specified dates before expiry. Most crypto options are European because a known exercise date simplifies pricing, margin, and hedging. Thalex lists European-style contracts.

Options Greeks

Greeks describe how an option responds to key drivers. Delta measures sensitivity to the underlying. Gamma measures how fast delta changes. Theta measures time decay. Vega measures sensitivity to implied volatility. Rho measures sensitivity to rates. Use Greeks to size, hedge, and choose structures. Monitor how exposures evolve as price and time move. Align Greeks with your forecast on direction, speed, and volatility.

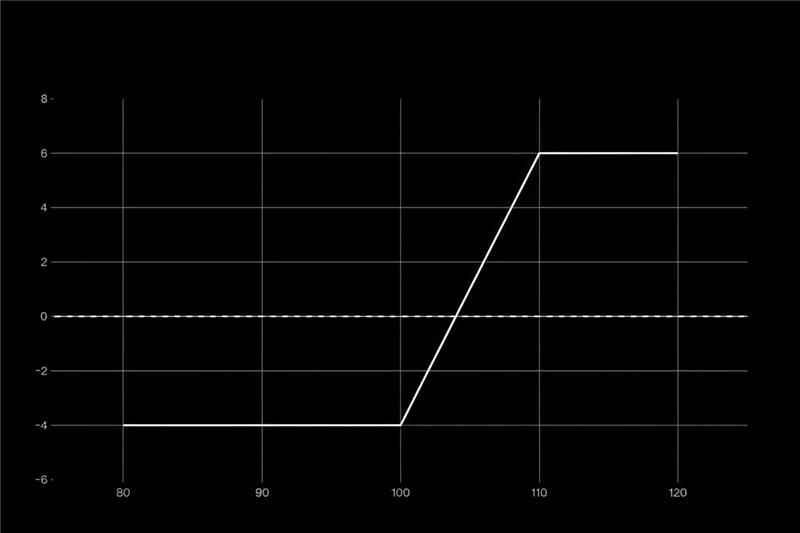

Asymmetric Risk-Reward Profile and Convexity

Long options have defined risk and open-ended potential. Your maximum loss is the premium, while gains can expand quickly if price moves your way. Short options collect premium but carry larger risk unless capped. Spreads shape the trade-off between cost and payoff. You can risk a little to aim for large outcomes. Position sizing and exits keep the asymmetry working for you.

Convexity is the non-linear payoff that makes option gains accelerate when moves extend in your favor while losses remain capped at the initial spend. It is powered by gamma and time. Owning convexity helps capture large moves and manage gap risk. Convexity can be bought outright or rented with spreads. It is most valuable when movement is likely and pricing is fair. Discipline turns convexity into realized edge.