Order Types at Thalex

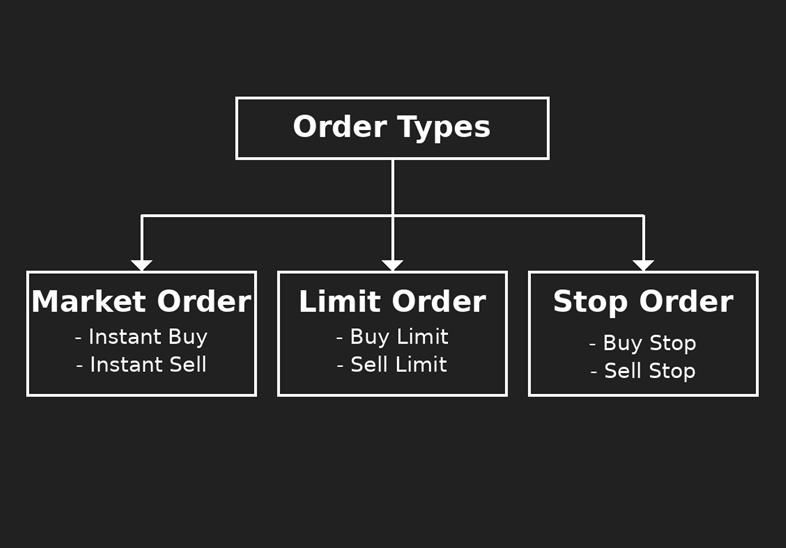

When you place an order on Thalex, you're telling the engine what to trade, where to price it and how to handle fills and risk. Pick the right type to control execution, speed and inventory.

Market Order

Executes immediately against the best available price. It prioritizes speed over price. Expect slippage if liquidity is thin or the tape is moving.

Example: BTC trades around $111,168. A market buy for 2 BTC lifts the resting offers until the size is filled. If the book shows 1 BTC at $111,170 and 1 BTC at $111,200, then the average fill is $111,185.

Limit Order

Posts liquidity at your chosen price or better. You control the worst acceptable price, but there is no guarantee. Queue priority matters.

Example: You bid $111,120 for 3 BTC. You fill only if the sellers hit your price. If the market never trades down, the order rests or cancels per your time-in-force.

Stop-Market

Triggers a market order once the stop price is reached. Useful for cutting risk or protecting gains. Fills are likely, but can slip trough levels in fast moves.

Example: Long 2 BTC from $111,300. Place a stop market, when price trades down to this level, the stop fires and sells at the best bids available.

Stop-Limit Order

Triggers a limit order once the stop price is reached. You control the worst execution price, which avoids extreme slippage, but you can miss in fast markets.

Example: Same position. Set stop at $109,800. If the markets gaps below $109,800, the order may not fill.

Trailling-Stop

A dynamic stop that follows the market by a fixed amount or percent. It locks in gains while leaving room for the trend.

Example: You long BTC and set a $600 trailling sell stop. If price rallies to $112,200, the stop ratchets to $111,600. If the price then falls below this level, the stop triggers.

Bracket

One-click risk wrapper that places a take-profit and a stop-loss around a new or existing position. One cancels the other when filled.

Example: Enter long 1 BTC at $111,110 with a bracket of + $900 and - $700. The system places a reduce-only take-profit at /$112,000 and a reduce-only stop at /$110,400. When either executes, the other cancels.

Time-in-force

Good-Till-Cancelled (GTC): the order rests on the book until it fills or you cancelt it.

Immediate-Or-Cancel (IOC): any portion that cannot fill immediately is cancelled. Useful for taking partial liquidity without leaving a remainder on the book.

Order Flags

Post-Only: ensures your limit order adds liquidity. If it would cross the spread, it is cancelled instead of taking. Use this to earn maker rebates and avoid taker fees.

Reduce-Only: guarantees the order only reduces or closes and existing position. If it would increase exposure, it is rejected or adjusted down. Pair this with stops and brackets to prevent accidental slippages.

Ignore Price Collars: allows submission of a limit price outside the default client collar. The engine still validates prices. Use only if you know the venue-side bounds and want far-away resting orders.

Practical Tips

- Market orders trade speed for certainty of fill. Size them to the book to control slippage.

- Limit orders trade price control for fill certainty. Improve price to gain queue priority.

- Stop market cuts risk quickly. Stop limit cuts risk at your level, but can miss.

- Trailing stops help ride trends without screen-watching.

- Combine GTC for resting liquidity and IOC for opportunistic taking.

- Always tag protective exits reduce-only so they never add risk.

- Use post-only for maker programms and to avoid accidental taker prints.