While the goal is the same, the mechanism for shorting with derivatives is different. Instead of borrowing an asset, you are speculating on its future price through a contract. Your profit or loss is determined by the difference between your entry and exit prices in this contract.

When you short on a derivatives exchange, you are not borrowing the actual cryptocurrency. Instead, you are opening a futures or perpetual swap contract that obligates you to sell the asset at a future price.

- Opening a Short Position: You initiate a "sell" order on a derivatives contract. This means you are agreeing to sell the underlying asset at the current market price at some point in the future.

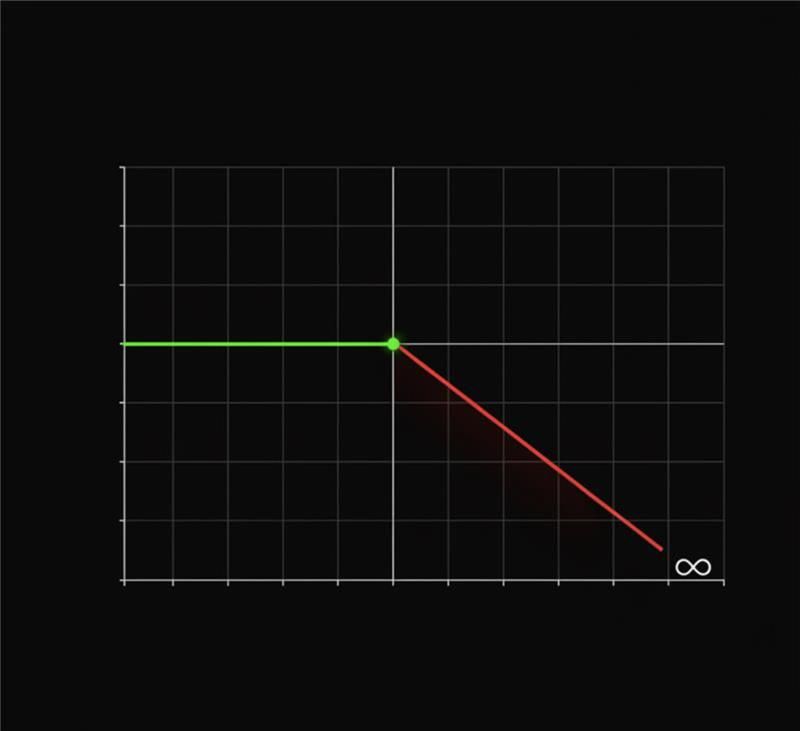

- Profiting from a Price Drop: If the market price falls, you can later "buy" back the same contract at this new, lower price to close your position. The difference between your higher selling price and your lower buying price is your profit.

This process of selling high first and buying low later is the inverse of a traditional long trade.

With derivatives you short by selling a perp or dated future. PnL increases as price falls. Watch funding on perps and your maintenance margin.