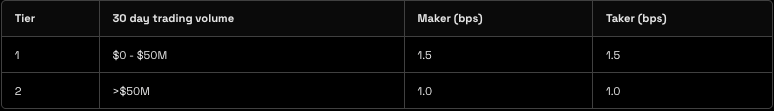

New Maker-Taker Fee Model for Tier 1 Options

Tier 1

- Options: Will change from 2.5 bps to 1.5 bps for both maker and taker

What does Maker/Taker mean?

Limit orders that are placed into order books are providing liquidity. Exchange users that place such orders are said to be "making the market". A fill (trade) on an order in an order book is a maker trade, and is charged the maker fee rate.

If an order is placed such that it immediately trades against other orders in an order book, it is removing (taking) liquidity. Such order is charged the taker fee.

A limit order can be partially filled against the book orders when it is placed. In this case, the immediately filled portion of the order consists of taker trades. The unfilled portion of the order is placed into the order book, and can later be filled with maker trades.