Futures Rolls Recap

In our last blog, we talked about the basics of futures rolls. Futures rolls are a combination trade where you sell a perpetual and buy a future, or sell a shorter-dated future and buy a longer-dated future in a single transaction. The trade is atomic, which is to say either both legs of the trade execute or neither of them do, which makes them low risk. On Thalex, we also offer a 50% discount versus buying each leg seperately. This means futures rolls are capital-efficient and low risk instruments that are handy when your trading strategy involves delta-neutral futures and perpetuals positions.

We also mentioned Implied Matching, but did not go into details. This is the subject for today.

Makers and takers

For every buyer there must be a seller. When you come to trade on an exchange, there must be someone waiting for you to take the other side of your trades.

Those traders that are waiting for you, they are said to be providing liquidity or making the market.

When you come to trade, your trades are 'taking' some part of the available liquidity. Hence, you're a taker.

Back in the days of trading pits, a market maker would have been a real person standing there in the pit, ready to offer you a price to trade. Nowadays, exchanges are online, and takers 'meet' makers in the electronic order books.

Makers would put orders onto the books, specifying the amount they can offer to buy or sell, and the price at which to trade (limit price). A taker order will then be matched against the orders on the book. A number of orders from the book can be used up to fill the taker's order amount. Orders with best limit price (best for the taker) will be picked first.

Implied matching for futures rolls

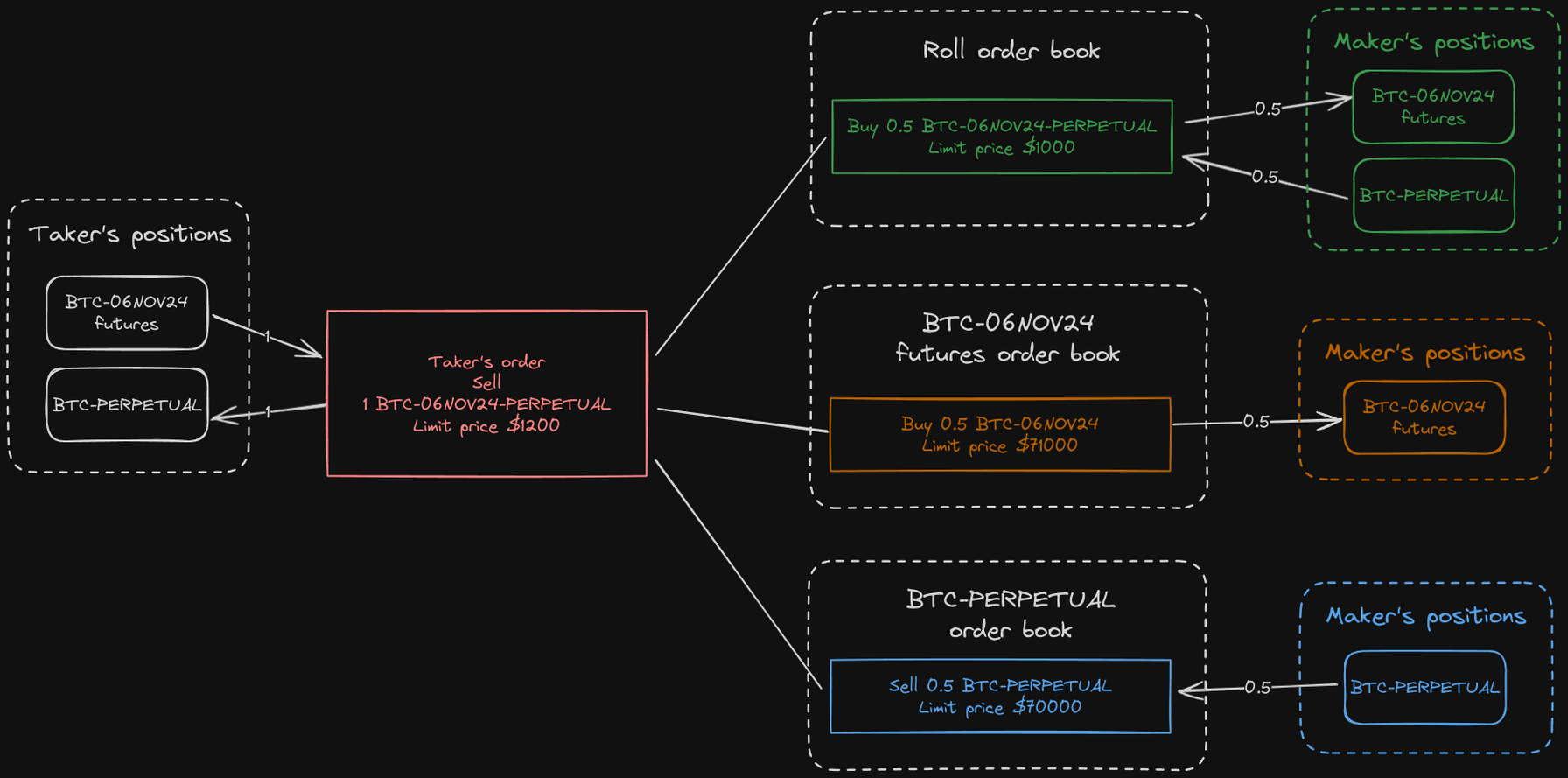

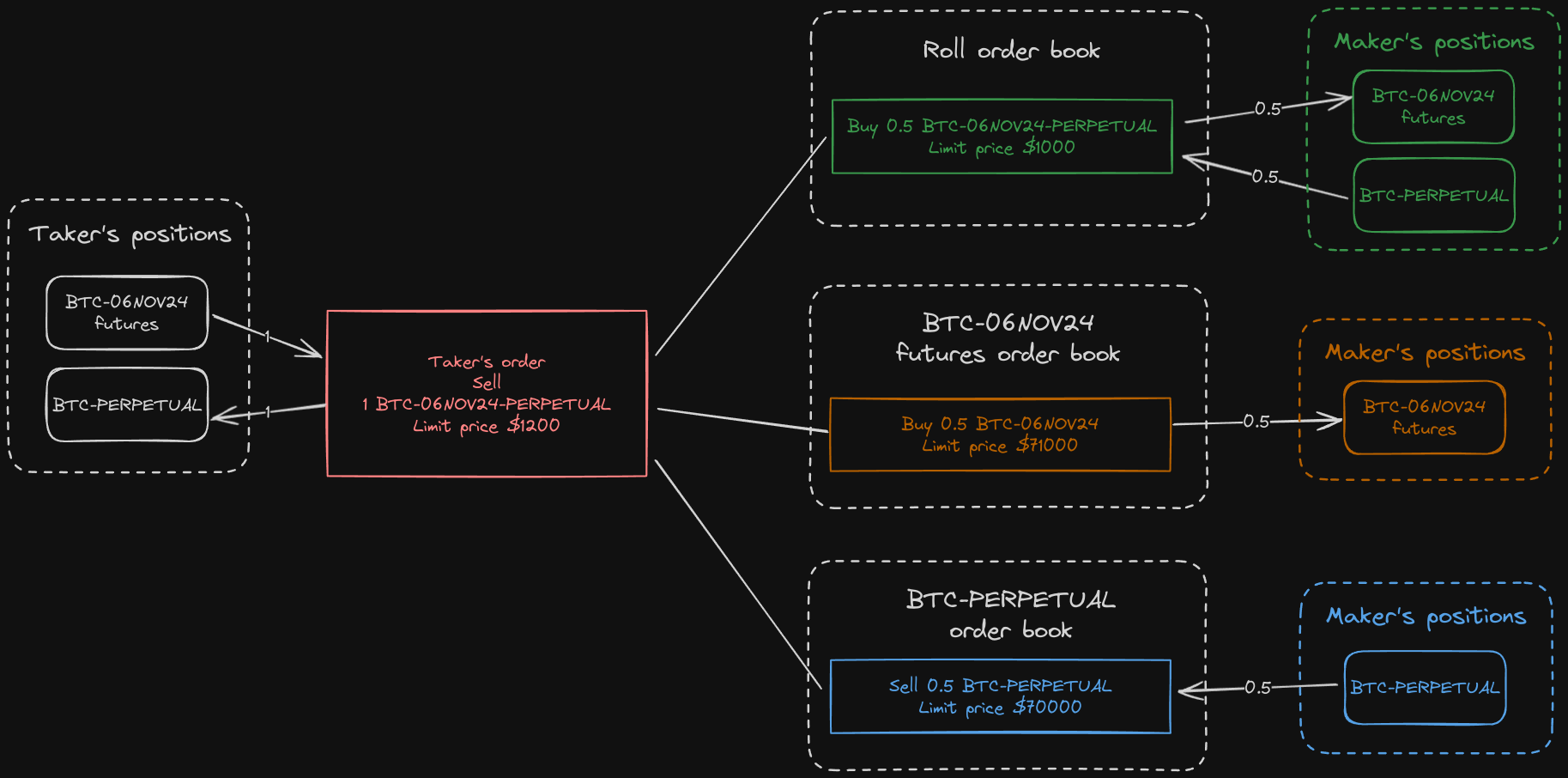

Ok, so coming back to capturing futures premium. You want to sell a futures and buy a perpetual, which is the same as selling a futures roll. This means someone must be there waiting to buy one from you.

But at the same time, there can be two makers waiting for you, one willing to buy your futures, and one willing to sell you a perpetual.

And 'waiting' here obviously means having limit orders on the respective order books. Three books involved in total: one for the futures roll, one for perpetual, and one for the futures.

On Thalex, both ways of matching are automagically used together.

First, we build a single order book out of the three. The orders from the futures roll book are taken as is (we call them outright orders). The orders from the perpetual and the futures book are grouped in a way that they represent the futures roll (we call them implied orders).

The two lists are merged and ordered by price and priority, effectively making it a single combined order book.

We then match your futures rolls order against this combined order book.

All this happens right inside our matching engine, for every order. No extra action needed from you. In fact, the order book you see in our trading interface is the combined order book, and you just place regular limit or market orders against it.

All trades on all involved order books form a single atomic operation, there is no slippage possible.

You are thus guaranteed best order fills from both worlds, outright and implied.

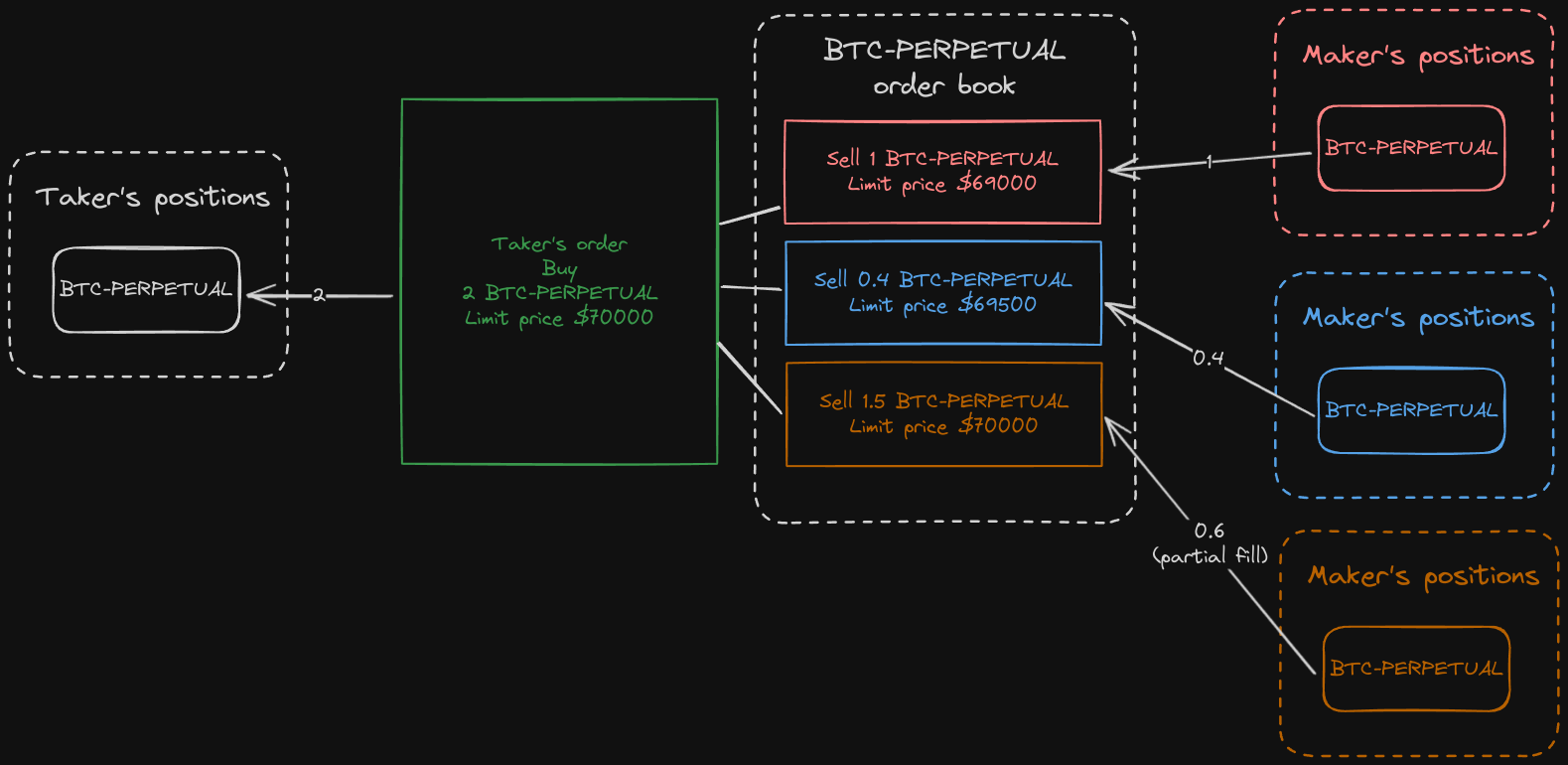

Awesome. But there's even more, implied matching also works for orders in futures and perpetuals.

Implied matching for futures and perpetuals

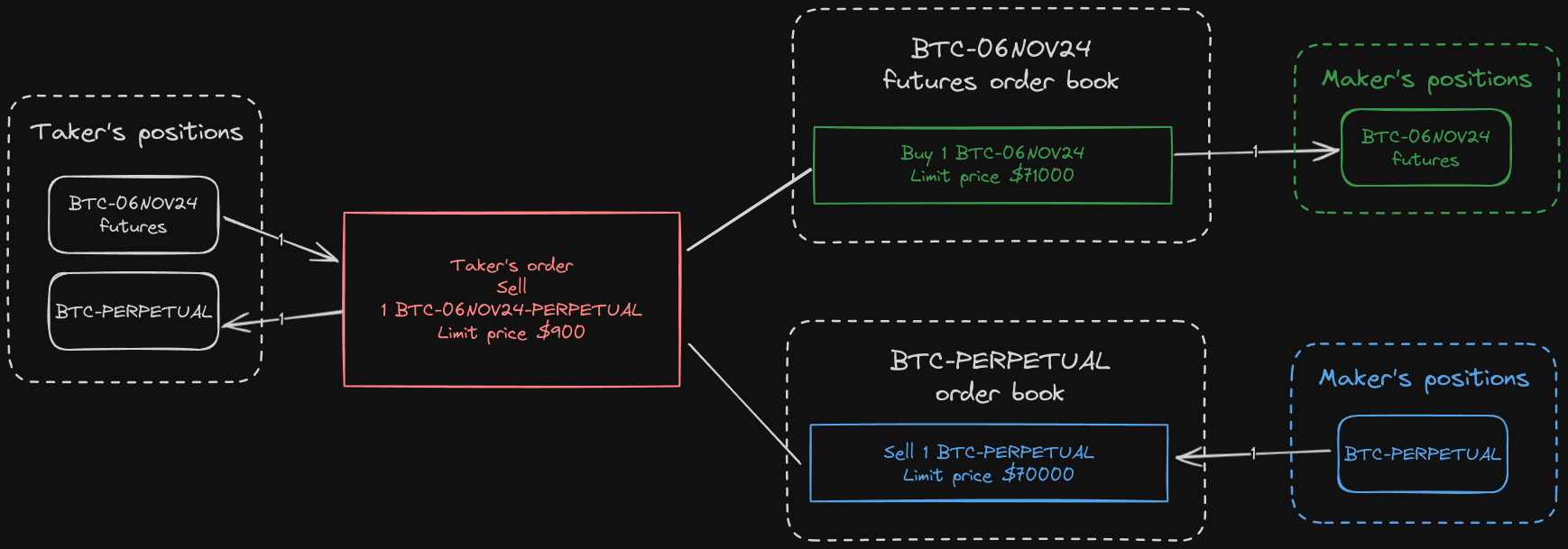

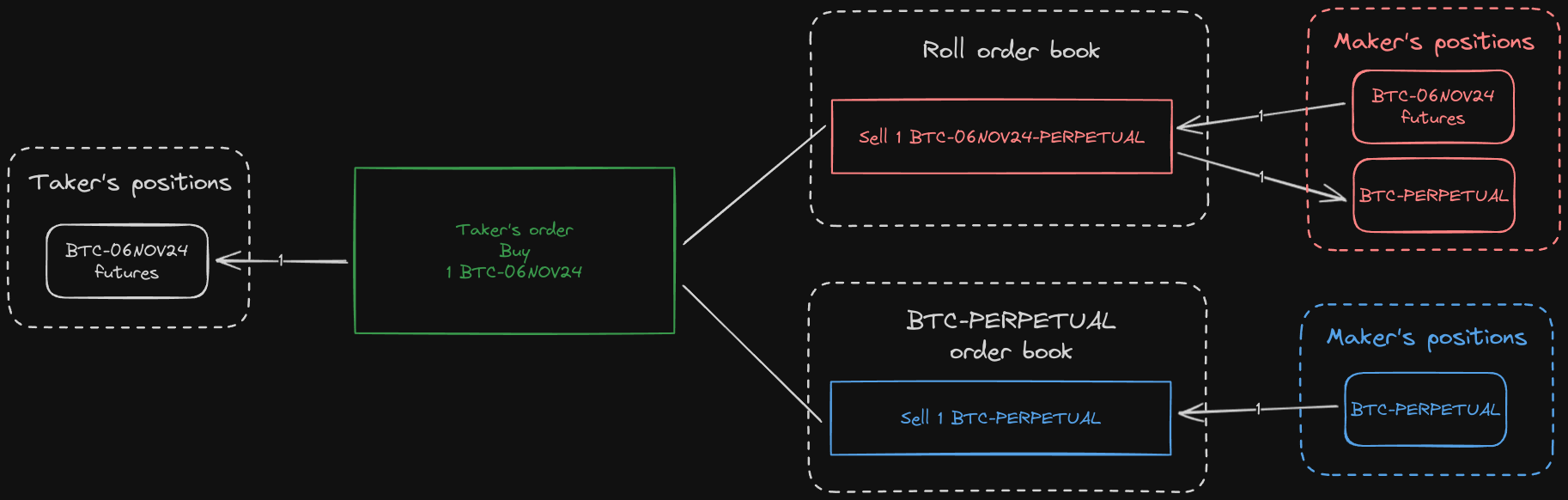

Imagine you want to buy a futures for some expiration. But no one is selling.

However, there is some maker selling a futures-perpetual roll for your expiration. And someone else is selling a perpetual.

Here's is what our matching engine will do for you:

- Buy the perpetual.

- Buy the futures-perpetual roll. This is the same as buying the futures you need and selling the unneeded perpetual (that it has just bought).

The net end result is that you get the futures you wanted. Again, it's all happening atomically inside our matching engine, so you don't need to do anything except placing a regular limit order on the futures.

You will actually see this trade opportunity in the futures order book, as if someone was offering the futures for sale.

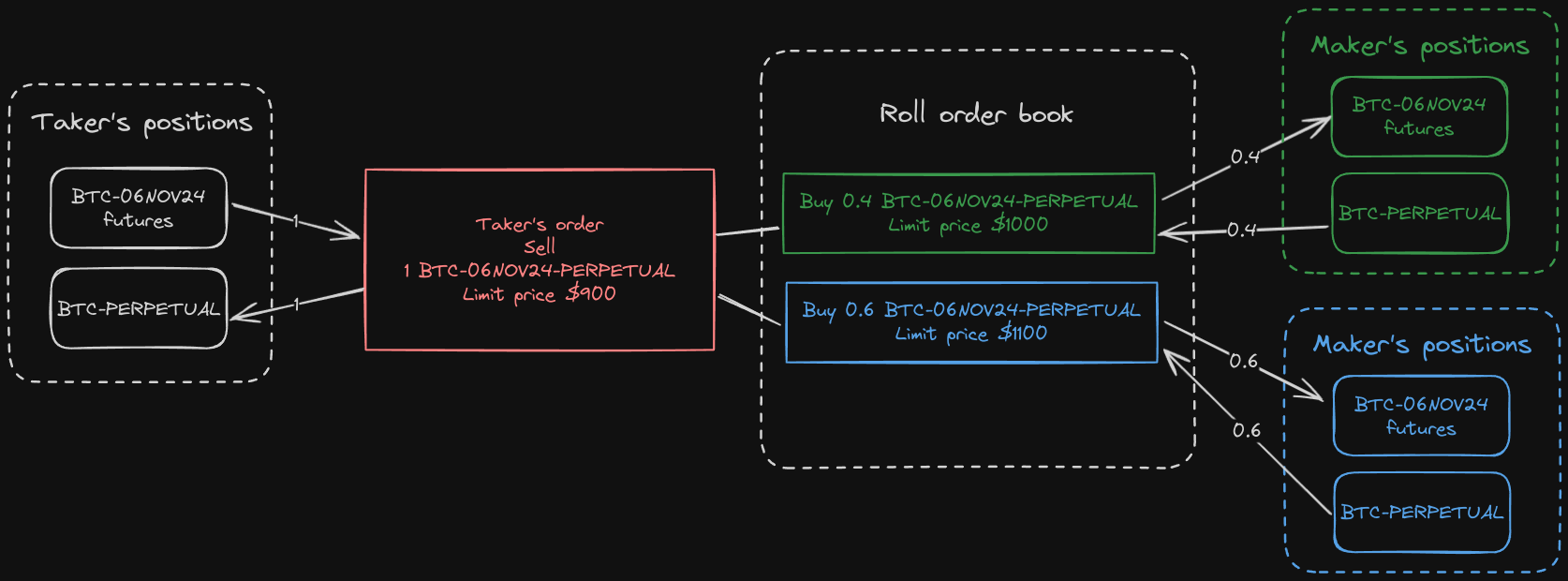

Implied matching obviously works between all futures and perpetuals that are linked with rolls. It's also not limited to a single link. Your perpetual order can, for example, be filled by a combination of multiple trades from multiple futures rolls and futures order books.

Recent trades

Conventionally, when you see a list of recent trades published by an exchange, those are trades on the taker side of the book.

On an exchange without implied matching this makes sense. Each taker trade may correspond to a number of maker trades, so showing the taker side is grouping those trades together. The number of contracts traded is always the same on the taker and the maker sides.

As you can see now, on Thalex, with implied matching, taker and maker trades don't necessarily happen on the same order books. There can also be more contracts traded on the maker side than on the taker one. Therefore, showing only the taker side of trades does not allow to see the full picture.

To solve this, we will show you "implied taker trades" in the recent trades lists. Those represent the "taker" part in the implied match that led to an order fill on the book.

Taking the same example as above, you're buying a futures (with a taker order). This takes out two maker orders:

- One selling a perpetual, on the perpetual order book.

- One selling a futures-perpetual roll, on the roll order book.

We will show the following recent trades:

- On the futures book: "buy futures".

- On the perpetual book: "buy perpetual / implied taker".

- On the roll book: "buy roll / implied taker".

Note that since the orders were maker orders, the implied taker trades are shown on the opposite side of the books.

Well then

To summarize, futures rolls are capital-efficient and low risk instruments that are handy when your trading strategy involves delta-neutral futures and perpetuals positions.

With implied matching, Thalex improves liquidity in futures and perpetuals order books with no extra work for you.

However, mind the differences in how recent trades are listed. If your trading strategy uses recent trade lists as an input, make sure you account for implied taker trades correctly.

Enjoy trading!