Capturing a futures premium

A futures contract is essentially an agreement to trade some asset at a specific price at a specific time in the future (expiration date).

Thalex offers futures contracts on Bitcoin and Ether index prices. An index price in our case is a combination of spot-fiat prices on multiple spot exchanges. Since the index is not a physical asset, we cash-settle futures contracts. This means that no Bitcoin or Ether changes hands, but the price difference between the futures contract prices and the index price at the moment of entering the contract is settled as the profit or loss. This price difference is called the futures premium.

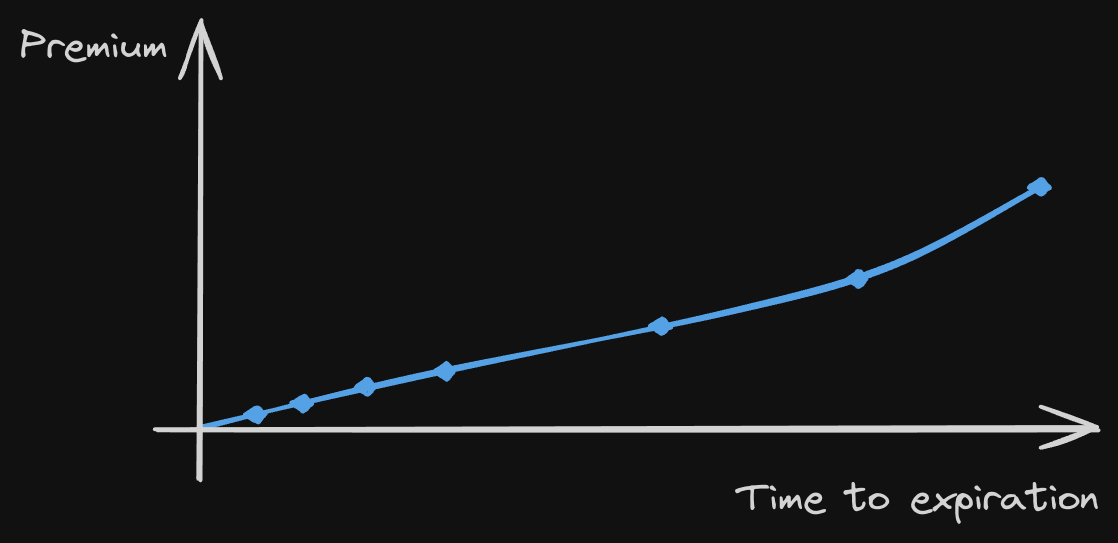

On any day, there will be about ten different expiration dates offered to trade on Thalex. Typically, the futures premiums for further away dates will be higher than for the near terms. As time to expiry nears zero, the futures price will naturally converge to the underlying index price, and the premium will become zero at expiration.

(Strictly speaking, futures don't always cost more than the index. For a curious reader, our advice is to look up contango and backwardation terms, and continue from there.)

As a trader, you can capture the futures premium. For this you need to sell a futures, "buy the index", and wait for the futures to expire (the futures price will converge with the index). Assuming the futures did cost more than the index on the day you entered the position, the price difference is your net profit when it expires.

Now, "buy the index" is not really a thing, because again, the index is not a physical asset. But on Thalex we have the next best thing: a perpetual. Perpetual contract price is closely following the index price because of the funding mechanism.

So your trade becomes:

- Sell a futures.

- Buy a perpetual.

- Wait till expiration.

- PROFIT!!!

(Again, for the curious reader, you can look up cash-and-carry trades.)

Sounds easy, right? Well, there's always some catch.

Futures premium in portfolio margin world

There are obviously risks associated with trading futures. The most obvious is the potential loss when the underlying index moves against you.

Futures and perpetual prices typically move together with the underlying index price. The index price goes up one dollar, all the futures prices also go up one dollar. Down one - down one. You can often see futures called delta-one instruments. Delta is a greek letter used for denoting the correlation between the underlying price and the instrument price; for futures and perpetuals this is a one-to-one correlation.

So, if you just hold one futures or perpetual contract, any downwards move of the index is your loss.

If, instead, you have sold one futures contract, and bought one perpetual, the profits and losses from index moves cancel out. You're then said to be holding a delta-neutral position.

A position with one long and one short futures contracts is called a roll position (same if it has a perpetual instead of one of the futures.)

Holding a roll position protects you against the index moves, but does not eliminate your risk entirely. For example:

- Futures premiums might go up before finally converging to zero, realizing some (temporary) loss for you.

- When your futures expires, you're left with just the perpetual position that is not delta-neutral anymore.

- There's liquidity risk if you want to exit the position early.

- Perpetual funding might temporarily go against you.

On Thalex we use a portfolio margin model. This model is basically a (rather sophisticated) math formula, that estimates how much risk your portfolio carries. This, in turn, determines how much collateral you need to place in Thalex custody to guarantee that you can cover eventual losses (see our Portfolio Margin page for more details.)

Greatly simplifying, a non delta-neutral futures portfolio requires about 20% of the index price in collateral (for Maximum Loss Coverage). Whereas a delta-neutral one requires about 2% (for Roll Contingency).

Since roll positions are delta-neutral, they are relatively more capital efficient. You can thus use more leverage to multiply the effect of the premium capture.

There are some pitfalls though.

Because a roll position consists of two instruments, you'd need to "leg into it": enter each of the two legs with separate orders. Imagine you have just entered one, waiting for your order on the other leg to fill:

- Your portfolio in the meantime is not delta-neutral and requires a lot of collateral.

- The price of the other leg might change, making the trade not profitable anymore.

- The liquidity on the other leg might not be sufficient to enter a delta-neutral position.

- If in the end you can't enter the other leg, you'd need to get out of the first one, likely loosing when crossing the bid-ask spread.

So, just entering a roll is risky. Same logic when you need to exit it. Many exchanges would just say 'tough luck, this risk is yours'. On Thalex, though, we have a solution for you. Enter Futures Rolls.

Futures Rolls

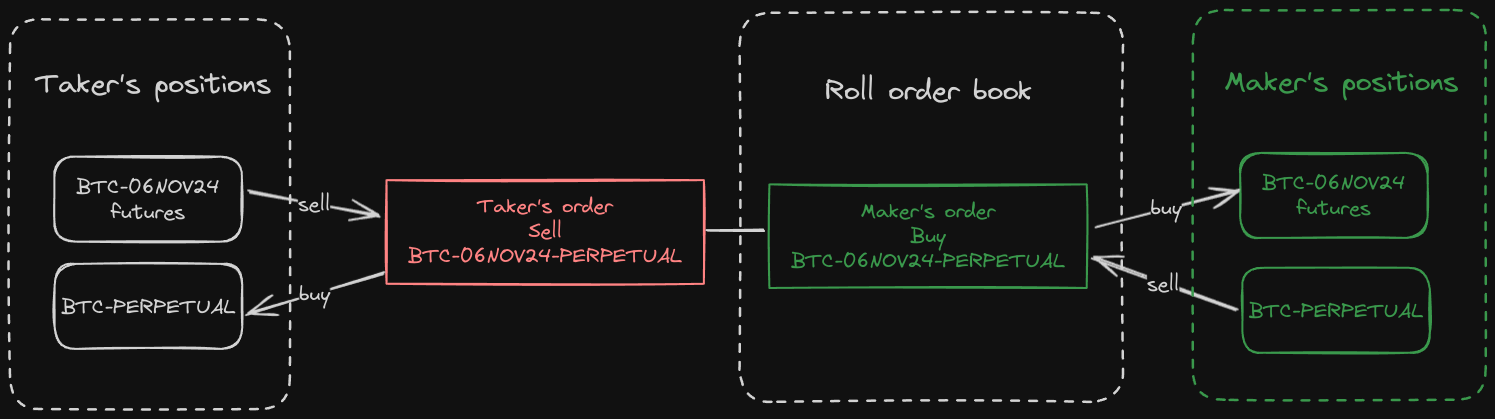

A futures roll is an instrument that allows you to enter both legs of a roll position in one go. That is, with one order, 'atomically'.

The futures roll order has one price, which you can see as the difference between leg prices. It either trades at this one price, or does not trade. So there's never a risk of getting stuck with just one leg.

There's also no point in time when your position is not delta-neutral. So you don't need extra collateral just for the time you enter it.

There are two types of futures rolls on Thalex: between a perpetual and futures, and between two futures of different expiration dates.

Buying one contract of a futures-perpetual roll means buying one futures and selling one perpetual. Selling a roll is naturally the opposite: selling the futures and buying the perpetual.

For futures-futures rolls, buying the roll will buy a longer-dated futures, and sell a shorter dated one. Selling is the inverse.

An important detail here is that once your futures roll order is traded, you're holding two independent positions of its two legs in your portfolio. Those positions are not linked in any way, it's not a single position in the roll instrument.

This allows for great flexibility. For example, you can enter a roll position with a futures-perpetual roll, and then keep rolling the futures leg to later expirations with futures-futures rolls.

Sounds nice, right? But there's more.

First of all, Thalex will only charge trading fees on one leg of the roll order. You basically get into two positions for the price of one. It's just one order after all.

Second, when you place a roll order, it's not only matched against orders in the roll order book. We additionally match it against orders on the books of its legs. So you get much better liquidity.

We call it implied matching, and it guarantees the best possible price on Thalex. In our next blog, we'll dive into how it works.

In the meantime... Enjoy trading!