Change in Futures Rolls fee

At Thalex, we're all about cutting down trading friction to make your trading experience smoother.

That's why we've rolled out an update on how fees work on Futures Rolls.

As of the 6th of January, fees on Futures Rolls are calculated as a percentage of the Rolls mark price, instead of the index price.

The Future Rolls trading fees are calculated as of the formula below and apply to all to both BTC and ETH as the underlying.

The fees charged are split equally between trades in each leg of the Futures Rolls contract.

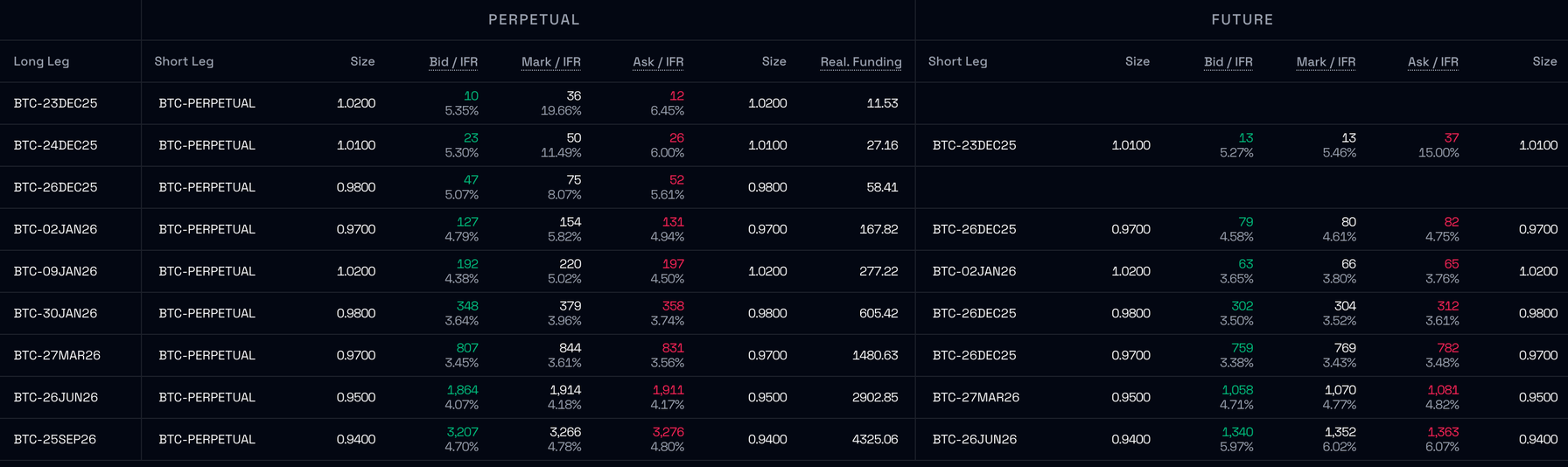

For example, in the above screenshot, you trade a Rolls with BTC-23DEC25 and BTC-PERPETUAL. Fees are calculated as follows:

Each leg of the Rolls will display a $0.9 fee.

These changes lines up fees with the true value of the roll, lowering friction and keeping costs low. The core Futures Rolls feature hasn't changed, just the fee math that's changed.

Why this matters

Switching to mark price for Futures Rolls fees brings real advantages:

- No friction from index divergence

- Based on actual trading conditions

- Lower and more predictable fees

How to use Futures Rolls

Futures Rolls let you shift an open futures position from one expiry to the next, all in one seamless trade. No need to close out and reopen manually, which saves time and hassle.

Picture this: You're long on a BTC futures contract that's about to expire, but you want to hold your exposure.

Instead of two separate trades, just execute a Futures Rolls. It happens in a single transaction, dodging execution risks, minimizing slippage, and keeping your position open without interruption.

Fees apply once on the Rolls, and now they're pegged to the mark price, ensuring they match real trading conditions.

For more information, visit: Introduction to Futures Rolls

Start Trading Futures Rolls

Jump in and take advantage of these lower, more predictable fees on Futures Rolls today. Head over to the Thalex exchange and get rolling.

Originally scheduled for December 23rd, 2025.